Payoneer Nigeria ▷ Create and Verify Your Account in 2024

Lot of people want to learn the procedures and basic requirements to create and open Payoneer account in Nigeria to verify, fund, send and receive money easily.

Are you one of them?

If YES, then this article is only what you need to read today.

After reading this post to the end, you will create a verified Payoneer account in Nigeria.

Getting started…

What is Payoneer?

Payoneer is the world’s go-to partner for digital commerce, everywhere.

From borderless payments to boundless growth, Payoneer promises any business, in any market, the technology, connections and confidence to take part and flourish in the new global economy.

Powering growth for customers ranging from aspiring entrepreneurs in emerging markets to the world’s leading digital brands, Payoneer offers a universe of opportunities, open to you.

For 15 years, Payoneer has pioneered this new reality. Serving markets others will not. Solving problems others cannot.

Innovating tools others have not. Pushing frontiers, making connections, unifying, and creating global ecosystems.

What makes Payoneer important?

These are reasons you should have a working Payoneer account in Nigeria.

- Apply for a debit card which you can use for online payments and for funds withdrawal at ATMs.

- Create virtual bank accounts to receive payments from American and European companies.

- Get paid by your global clients.

- It is free to use! You are not charged any service fee for creating an account.

- It is used in making purchases online, sending money abroad and in receiving international payments from affiliate networks and freelance sites.

- No restriction on payments to foreign destinations.

- Once you receive $1000 in payments into your account, you will receive a $25 reward from Payoneer.

- Safe and trusted in over 150 countries.

- There is no need to change your IP address or use VPN to access the website in Nigeria.

- Withdraw funds at ATMs and to your local bank account at low rates.

- You don’t need to use fake information to get an account in Nigeria.

- You get discounts regularly from big brands around the world.

Requirements to Open a Payoneer Account in Nigeria

These are Payoneer account eligibility requirements in Nigeria:

- Debit or credit card (Visa and MasterCard are accepted).

- Email address.

- Legal name on your birth certificate and documents.

- Mobile phone or PC.

- Nigerian bank account.

- Strong password.

- Valid means of Identification.

- Working phone number.

- Your address/location will be required.

- Your business name, information, document, and address will be required (for business account).

Only provide truthful and accurate information or else you will lose your account no matter how much you have in it.

Steps to Creating Payoneer Account in Nigeria

Here are the right steps to create a verified Payoneer account that sends and receives money in Nigeria:

1. Visit Payoneer Site

Once the page finishes loading, go to the top of the page and click “Sign Up and Earn $25” to set up your account.

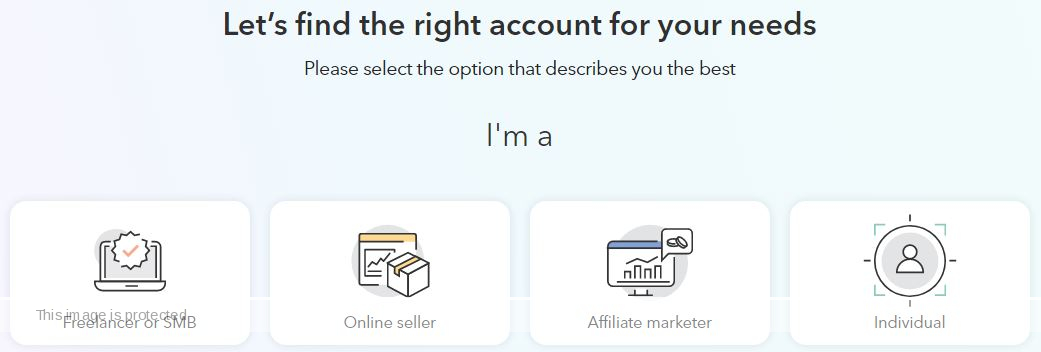

2. Find Right Account for Your Needs

Select the option that best describes you the best.

To send and receive money, choose Freelancer/SMB or Affiliate Marketer, and click “Get paid by international clients or freelance marketplaces” to proceed.

Click “Register”.

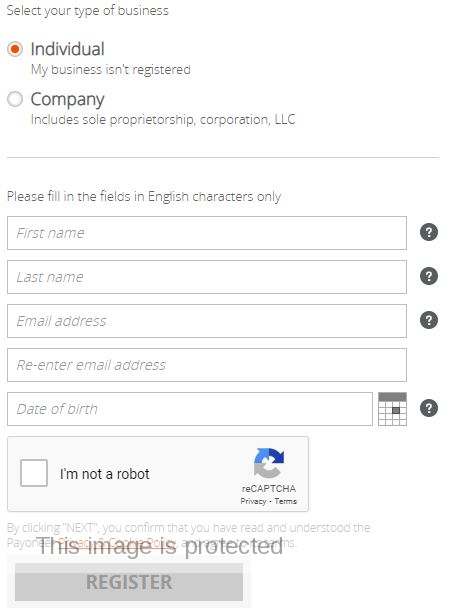

3. Select Your Business Type

- Choose “Individual.”

- Fill in the fields in English characters only.

- First name

- Last name

- Email address

- Date of birth

Verify that you’re not a robot and click Next.

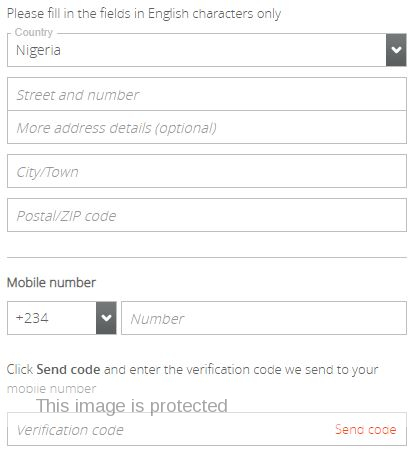

4. Enter Contact Details

Fill in the fields in English characters only.

- Country

- Street and number

- City/Town

- Postal/ZIP code

- Mobile number

Click the Send code and enter the verification code sent to your mobile number.

When done, click “Next”.

5. Enter Security Details

Fill in the fields in English characters only.

- Username

- Password

- Security Question

- Security Answer

- Issuing Country of ID (Nigeria).

- ID Type (National ID, Driving License or Passport).

Verify that you’re not a robot and click Next.

6. Fill in Your Nigerian Bank Account Details Correctly

After filling in your bank details, wait for them to review your account and you will get a message from them.

Sometimes it may take 24hrs or more to activate your account.

I have even come to an instance where it took about a week, but sometimes it takes just hrs.

7. Email Confirmation

On the next page, Payoneer will let you know that your newly created account is pending approval.

Your email address is what you will use for any transaction you make through Payoneer.

Before you can begin sending or receiving money on your account, you’re required to confirm your email address.

So, go to your email inbox and look for Payoneer confirmation email.

Open the mail and click “Confirm Your Email” button.

Best Banks to Withdraw Payoneer Funds in Nigeria

Send money from Payoneer to these bank accounts in Nigeria and withdraw Naira:

- Kuda Bank

- First Bank Nigeria (FBN)

- United Bank for Africa (UBA)

- Guaranty Trust Holding Company (GTBank)

- Access Bank

- Zenith Bank

Steps to Withdraw Money from Payoneer in Nigeria

Here are the steps to receive money with Payoneer in Nigeria:

- Log in to your Payoneer account.

- Enter your Nigerian bank account details.

- Choose which balance (i.e., USD, GBP, EUR, etc.) to withdraw.

- Specify the amount of the balance to withdraw.

- Send and check to confirm that your local bank received funds.

Steps to Link Your Domiciliary Account to your Payoneer

1. Open a Domiciliary Account

You should have a domiciliary account at this stage.

But, if you don’t have a domiciliary account, here’s a detailed guide on the best domiciliary account to open in Nigeria.

2. Log in and click on the Banks and Cards Menu

Log in to your Payoneer and go to the dashboard.

Find and click on the “Banks and Cards” option from the menu.

3. Click on Bank Accounts for Withdrawal

On the ‘Banks and Cards’ page, there are three cards.

- Bank accounts for withdrawal

- Receiving accounts and

- Payoneer cards

Click on the first card, Bank accounts for withdrawal since you want to link your domiciliary bank account to withdraw your funds.

If you’ve added a bank account previously, whether domiciliary, it’ll appear on the ‘Bank accounts for withdrawal’ page.

However, keep in mind that you can only add a maximum of 3 different bank accounts in total.

But if you want to add more bank accounts later, delete any of the 3 bank accounts to add the new account.

4. Click on “Add New Bank Account” and Fill Out the Form

On the ‘bank accounts for withdrawal’ page, click on the “add new bank details and fill out the form with your domiciliary account bank details.

Here’re the details to fill in:

- Account Type (e.g., Personal)

- Account Currency (e.g., USD, NGN)

- Click on the next button to add more details:

- Name of the bank from the dropdown

- Account number

- Checkboxes for terms and confirmation

Click on the next button to fill out the final data.

- Date of birth

- Password

How to Fund Your Payoneer Account in Nigeria

To fund your Payoneer card in Nigeria, find Payoneer account holders that will sell their fund for Naira.

Alternatively, sign up with websites that pay into Payoneer account.

You cannot fund Payoneer card by doing bank transfer from your Nigerian bank account.

Final Words

As a Nigerian business owner using Payoneer, you will probably get payments from customers in many kinds of foreign currencies.

In fact, using Payoneer means you can get local bank account details for US dollars, British pounds, Euros, Australian dollars, Canadian dollars, Singapore dollars, Japanese yen, and Hong Kong dollars.

If you are having issues getting your Payoneer Mastercard delivered using the free delivery method, you can fund your account with $50 to enable you request for it via expedite shipping (DHL or FedEX) which takes just 3 to 7 days to get to your doorstep.

Having followed all instructions in this post, you should have created your own Nigerian Payoneer, linked your card and verified your account.

If you have questions, please ask in the comments section below and a response will be made as soon as possible.